How to Fill Out a Check

It may be 2020, however paper checks are still significant in our financial system. Figure out how to fill out a check the correct way. Indeed, checks despite everything exist. They’re as yet a significant piece of our financial system.

Numerous spots still just acknowledge checks for the items or administrations, and let’s be honest—it’s sort of crude to simply hand somebody money for a wedding gift. A check is progressively formal and helps the individual to remember the gift you’ve given them.

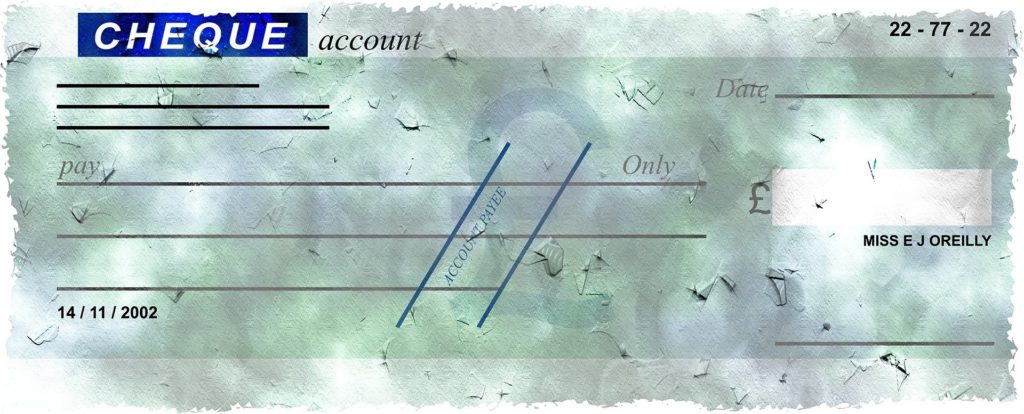

In this article I’ll walk you through how to compose a check, step by step, just as answer some basic inquiries concerning composing checks. Each step compares to that equivalent number on the picture underneath, so you can track with outwardly.

Step 1: Note the check number

Normally right in the upper right corner you’ll see a number—that is the check number. This lets you know and the bank which check you’re utilizing, and for what. The advantage to having a check number is that it makes it simpler to follow your payment if something turns out badly. For instance, in the event that you need to put a stop payment on a check, you’ll have to realize the check number.

A few people stress over utilizing a similar check number more than once. For example, on the off chance that you re-request new checks and overlooked the last known point of interest, you may wind up beginning with a check number you’ve utilized previously. Much of the time this won’t be an issue, except if you have to put a stop payment on it, at that point you may need to explain or recall the copy check number so you can stop the right one.

Step 2: Date it

In the upper right corner of your check there’s where you’ll enter the date you’re composing the check. You’ll write in the date close to or over “DATE” on most checks. Ensure it’s the right date (and year), this is frequently simple to destroy when we’re not considering it. Actually the check can be changed on any date after the date composed, yet on the off chance that you erroneously put a date later on, the beneficiary won’t have the option to money it until that date.

Sometimes you can postdate a check, yet this truly relies upon who you’re managing. In case you’re giving a check to a proprietor who realizes you well, for instance, yet you don’t need them to money it until you get paid one week from now, you can in fact compose the date for the following week on the check and they won’t have the option to do anything with it up to that point. The advantage is that they have the security of realizing you’ll pay since they have your check.

Step 3: Write who the check goes to (otherwise known as the beneficiary)

Just underneath the date you’ll discover an area that says “Pay to” or “Pay to the request for.” This is the place you assign who is really accepting the check. This is regularly a solitary individual, a couple (for example Samantha and Paul Jones), or a company or store (for example Wal-shop). At times, the beneficiary will request that you work it out to “Money”— this is alright as long as you probably are aware the individual you’re offering it to. By working it out to money, anyone can money the check.

In case you’re uncertain of whom to fill the check out to, consistently inquire. The exact opposite thing you need is to fill a check out to an inappropriate individual (who may simply feel free to money it) or compose the name inaccurately and need to pay a charge since they couldn’t money your check.

Typically spelling isn’t an issue, however in the event that it’s off track, at that point the bank may not be eager to money it. It’s in every case best to utilize the right spelling when you can. What’s more, you need to make a point to avoid any abbreviations, explicitly when managing a company.

For instance, in case you’re composing a company to Alec Baldwin Building Company, you would prefer not to express “ABB Co.” in the “Pay to” area. Regardless of whether Mr. Baldwin realizes that is the thing that he passes by, the bank may not money it, so utilize the full company name except if they explicitly disclose to you in any case.

Step 4: Write the dollar amount you’re paying (in numbers)

Just to one side of “Pay to” you’ll see a region that has a dollar sign with a case or a line in or on which to compose the dollar amount you’re paying. For instance, if your lease is $900, you’ll express “900” close to the dollar sign here. This part is truly plain as day, yet simply make sure you’re utilizing right cash accentuation when you’re filling this part out. Use commas and periods as essential.

Step 5: Write the dollar amount you’re paying (in words)

Presently this is the great part. This is the place everybody gets hung up on when composing a check -articulating your dollar amount. Just beneath the “Pay to” area, you should see a different line. That is for working out the dollar amount in words.

The essential principle on the most proficient method to do this is compose it like you state it. For instance, if your check amount is for $2,450, you’d state that as “2,000 400 fifty.” Numerous individuals likewise get lost by the hyphen (“- “) between numbers. You can forget about it altogether, a great many people or places couldn’t care less, however in the event that you need to utilize it, it’s in fact expected to be utilized for numbers somewhere in the range of 21 and 99. For instance, fifty-two. For anything over one dollar, work it out totally. For anything short of a dollar, utilize a portion (out of 100, since 100 pennies rises to a dollar). For instance, $0.42 would be “42/100”.

You’ll likewise see that numerous individuals utilize “and” during this segment. It’s the right method to work out a check, so I’d start doing it. You just need to utilize “and” before the quantity of pennies. Here’s a model:

Suppose your check is for $5,302.55. It would be worked out this way:

5,000 300 two and 55/100

Bode well? Toward the finish of this line you’ll see “dollars”— this equitable adds lawful lucidity to the reality you’re paying in dollars, not rupees or some other sort of money.

Step 6: Note what the check is for

This is more for individual following, yet it’s decent for the beneficiary to be helped to remember the reason too. In the lower left corner of your check you’ll see a segment that says “For” or “Reminder”— which is the place you compose a snappy note on what the check was utilized for.

Don’t over-convolute this part or compose excessively. In case you’re paying rent for January 2017 for instance, simply state “Lease 1/17” or something brief. Along these lines you realize what the check was for in the event that you ever need to return and look. Now and again, the individual or company tolerating the check will need you utilize this segment to recognize your record number or reference a particular receipt. In case you’re uncertain, inquire.

Step 7: Sign the check

This is the most significant part. On the off chance that the check isn’t marked, it’s not legitimate and can’t be changed. That turns into an issue when most places will charge you for composing an invalid check—since they at that point need to return and get the cash from you or have you sign the check.

Truth be told, most places won’t acknowledge a check that is not marked, however you’ll should know about this in case you’re mailing a check or offering it to somebody who isn’t focusing. This has transpired on innumerable events when I was gathering cash for our ball rec association—individuals would compose checks yet not sign them and I’d need to hold on to get the cash.

Other normal inquiries

- For what reason do we need to do work numbers out as words on checks?

It’s ensuring against a great deal of things, including check-washing, yet the essential explanation is for lawful purposes. The dollar amount you write (in step 3) is viewed as the graciousness amount, while working out the dollar amount in words in this step is viewed as the legitimate amount. On the off chance that there’s a legitimate disagreement regarding the check, the lawful amount will outweigh the civility amount.

- How would I void a check?

You can undoubtedly void a check by composing VOID as extensive as possible over the check. For good measure, I will in general shred them after this, except if the voided check is required for something (like direct store).

- How would I compose more than one name on a check?

This is a dubious one. Actually in the event that you state “and” at that point the two players must support the check before it very well may be gotten the money for. In the event that you express “or” at that point either gathering can. As a best practice, I’d recommend staying with “or” so the two individuals don’t need to sign the check.

- Would it be advisable for me to compose anything on the rear of the check?

Not except if the check is made out to you and you’re embracing it. In the event that you are, ensure you sign your name obviously over the line that says “Don’t Write Below This Line.” Also, your bank may require some extra content underneath the signature, for example, “for store” or “for versatile store”. Other than that, you compose nothing on the rear of a check.

- Imagine a scenario in which I jumble up the dollar amount, name, or something different.

It’s best not to traverse it, since this could mess something up if there’s a lawful disagreement regarding the check. My recommendation is to VOID the check and start with a new check.

Conclusion

While its 2020 and most transactions are electronic, there’s as yet a requirement for paper checks by and large. So it’s ideal to realize how to do it effectively.

As another best practice, it’s acceptable to monitor your checks any way you can. Regardless of whether you’re utilizing an electronic budget, or you’re utilizing an old fashioned check register, record it some place with the check number, the beneficiary, what it was for, the dollar amount. This will assist you with remaining on target with your Simple Spending Plan.