Investment Apps for Your Financial Needs

Investment apps offer lower expenses and the comfort of making exchanges in a hurry. Here’s all that you have to think about investment apps, in addition to a couple of our top choices. Business investors are dumping their financial advisors and stockbrokers for an application. That is on the grounds that investment apps offer lower expenses and the comfort of making exchanges in a hurry.

Investment apps additionally diminish the boundary to passage for new investors who can undoubtedly begin without much experience, time or cash. Investment apps are bringing stock market trading and business or financial planning to the digital age. Basically, they offer a platform for putting away your cash freely, without the requirement for a stockbroker or business or financial advisor.

We have identified beneath some well-known investment apps that will direct you in picking the best instrument for your financial needs:

Betterment

Overview

Betterment offers customized investment alternatives. It additionally automates the investment procedure through and through.

How it works

Betterment make investing contributing easy and reasonable for everybody. In view of your accounts, needs, objectives, and way of life, they give you a customized arrangement of low-cost index funds.

They assist you with choosing the amount to contribute and adjust with your bank so you have the choice of automatic contribution regularly. This robo-advisor settles on financial choices utilizing a mind boggling calculation, however what’s incredible about Betterment is that you additionally have the alternative of speaking to a financial expert.

Pricing

$0 least and 0.25 percent yearly expense for the standard record; $100,000 least and 0.40 percent yearly charge for the premium account.

Pros

- No related experience required

- Basic and easy investing

- Customized

- Financial advisor

- Low expenses

Cons

- Inflexible formula isn’t extraordinary for DIY-ers

- Constrained to overseeing Betterment accounts as it were

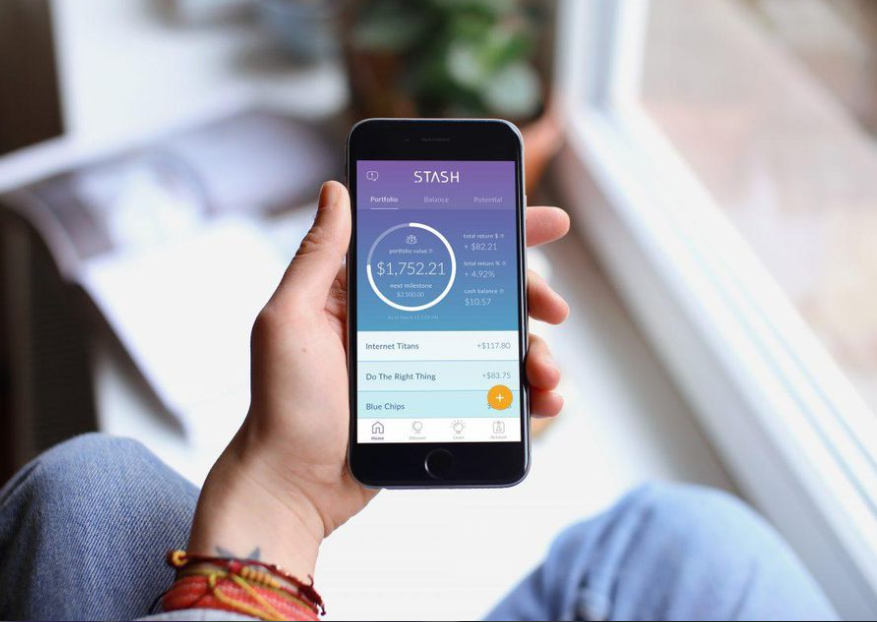

Stash

Overview

Stash is a simple investing application that is open to everybody. You can begin investing with with as low as 1 cent!

How it works

Motivated by the weight reduction industry, their way of thinking is tied in with making little, simple steps. Stash permits you to put resources into divisions of shares, which implies you can begin with as little an investment as you need.

They offer you a decision of approximately 1800 single stocks and ETFs. So there is a ton to choose dependent on your desired risk, financial circumstance, and way of life. What’s incredible about Stash is the way simple they make the entire procedure. They clarify everything en route and they considerably offer financial advisory services.

Pricing

Stash offers three different plans:

- Beginner – This arrangement is $1/month and offers an individual investment account, debir account access, and free financial training

- Growth – This arrangement is $3/month and offers all the highlights of the fledgling arrangement, in addition to tax cuts for retirement contributing.

- Stash – This is a $9/month plan that offers everything the other two plans offer, in addition debit card, a investing records for two of your kids, and month to month showcase bits of knowledge.

Pros

- Low barrier to start

- Simple to utilize

- Incorporates personal financial advisor

Cons

- The expenses can add up if you’re a small investor

- Restricted to their picked portfolios

- Special promotion: Sign up and add $5 to your investment account and get $5 added to your Stash banking account!

Acorns

Overview

Acorns permits you to browse portfolios made by Nobel-Prize winning market analyst, and naturally contribute your extra change.

How it works

Acorns links with your credit and check card and consequently “rounds up” the spare change to the the following dollar on each buy.

For instance, on the off chance that you purchased a latte for $3.60, they’d consequently store 40 pennies to your investment account, which can possibly indicate a considerable amount each month. In light of your desired risk, Acorns gives you the decision of five distinctive portfolio alternatives, which were made by Nobel Prize-winning financial analyst Harry Markowitz.

This is somewhat unique in relation to robo-financial specialists like Betterment that offer custom portfolios rather than the decision of a cfew pre-configured ones.

Pricing

$1 month to month charge for accounts with balance under $5,000; 0.25 percent of the parity every year on accounts over $5,000.

Pros

- Simple approach to invest without even noticing

- No minimum balance

Cons

- Your month to month savings may not be sufficient for a strong routine investment

- $1/month charge may not be justified, despite all the trouble in case you’re not contributing enough

M1 Finance

Overview

M1 Finance offers automated putting resources into pre-chosen portfolios, or you can look over any stock or ETF.

How it works

M1 is intended for individuals who like automating their investments, yet at the same time need some state on where their cash is going. M1 Finance permits financial specialists to look over any stock or ETF.

Dissimilar to robo-financial investors, you’re not confined to their pre-chosen ETFs, however they do offer preset formats for beginners. You can likewise set up repeating programmed deposits on a week after week or month to month premise, or any custom time span you want.

Pricing

Free of charge; $100 least to open a record and $500 least to open a retirement account.

Pros

- Offers an option to rigid robo-advisor formula

- Straightforward, simple, easy to use

- Free

Cons

- Restricted to 1 trade a day

- Can be mistaking for beginners

- No human financial advisor

Personal Capital

Overview

Personal Capital resembles an individual financial manager that offers exhortation, wealth management, and free financial tools

How it works

Personal Capital fills in as an advantage asset manager service, yet in addition gives accommodating free financial tools. Individual Capital connects to your financial records to sum up your funds and assist you with arranging and spending plan your accounts. You get a huge amount of highlights including a helpful retirement organizer or bill notice.

Personal Capital puts your cash in a preselected arrangement of individual protections and ETFs, explicitly to limit included costs and assessments. Each record additionally gets a committed advisor.

Pricing

0.89 percent charge for $1 million stored or less; you need at any rate $100,000 to begin utilizing services.

Pros

- Affordable

- Combines all your financial data

- Free finance tools

- Easy to use and set up

Cons

- High minimum

- Can’t customize your investment

- More costly than most robo-advisors

Robinhood

Overview

Robinhood is a basic stock trading platform with no transaction fee.

How it works

Robinhood offers a stage for purchasing and selling stocks and ETFs progressively. Best of all, you put resources into anything with zero exchange charges. You can likewise plan repeating stores in the event that you need.

Robinhood offers a too basic UI that is anything but difficult to utilize. You can see a basic outline of your investment execution with supportive graphs and details.

Pros

- Totally free

- Easy to use

- Easy to sign up

- Ideal for investment DIY-ers

Cons

- You must do your own research

- Easier to make rushed uncalculated decisions

- No customized investment recommendations

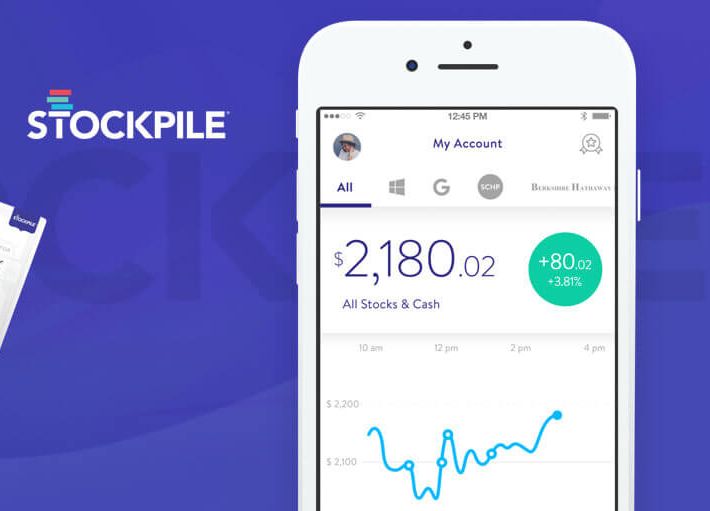

Stockpile

Overview

Stockpile is an investment financier application that permits you to purchase fragmentary offers and offers stock gift vouchers.

How it works

On the off chance that you need to purchase a particular supply of ETF, however would prefer not to pay for a whole offer, Stockpile permits you to purchase share portions. What’s particularly exceptional about Stockpile is that you can purchase stocks and ETFs as gift vouchers.

Trade can take up to a couple of days to get finished; it’s not perfect as a live trading platform. In any case, it’s an incredible choice for easygoing financial investors or tenderfoots. It’s likewise a decent method to find out about investing. Reserve offers a lot of learning assets and even lets kids make their own records with grown-up management.

Pricing

No minimum; $0.99 per trade; $2,000 maximum for gift card.

Gift cards cost $2.99 for the first stock and $0.99 for each additional stock, plus a three percent credit or debit card fee. The plastic cards cost $4.95-7.95 depending on the value of your gift.

Pros

- Not limited to expensive stock buy-in cost

- Unique gift card option

- Low fee per trade and no annual fees

- User-friendly interface

- Allows minors to participate

- Great way to learn about trading

Cons

- Longer processing time

- Not all stocks are available

- Gift recipients are stuck using this platform

- High gift card fee

- No live customer support

- Limited research tools

Conclusion

Investment apps engage anybody of any methods or ability level to begin investing without any problem. Your application can assist you with setting up an investing record and offer financial exhortation dependent on your way of life and salary. They can likewise automate the entire procedure so you can keep fabricating your investment without much effort.

Numerous financial investors are finding that the huge focal points of investment apps make the risk worth taking. By supplanting human advisors with a calculation, apps have a lot of lower overhead and can bear to keep their expenses essentially lower. Some apps much offer free exchanging. Access your financial data, make alterations, or purchase and sell anyplace you can associate with the Internet. You don’t need to trust that the work day will begin. The application works nonstop for you.