Simple Mortgage Calculator

A simple mortgage calculator helps you in computing mortgage payment summary with essential variables based on which mortgage agreements made. One can easily calculate the impact of changes in one or more variables on financial out-turn. A simple calculator considers only essentials variables like down-payment, interest rate, loan term, etc. but an advanced calculator can also calculate other monthly or yearly taxes and payments along with the mortgage amount e.g., local real estate tax and property insurance.

There are various software and websites which can calculate mortgage loan. Some tangible calculators are also available in the market for financial implications such as BA-II Plus by Texas Instruments and HP-12 C by Hewlett Packard.

This article discusses the different terms related to Mortgage and Mortgage Calculator.

Mortgage Loan

The load, which is raised mainly for purchasing real estate with a lien on real property in return, is known as a mortgage loan, and this legal agreement between borrower and lender is known as a mortgage.

A mortgage loan is mainly termed as a loan by banks and other financial assisting institutes. The mortgage loan is different from the conventional study loan and personal loan.

As in mortgage loan, the interest rate is set as per the current market, but in other investments like education load, the interest rate is as per the market when you started paying back like 4-5 years after.

Mortgage Load Scenarios

There can be two scenarios for a mortgage loan;

First Scenario: Funding Raising for Purchasing Real Property

In this first scenario, the borrower wants to buy a real estate property, but he doesn’t have much money. He then goes to the bank for a mortgage loan. In the first step, the borrower has equity as per the percentage of the Amount he deposited as a down-payment.

The remaining Amount then took as debt from the bank or financial institute to equal the amount of purchase. The borrower has to pay a fixed interest rate every year. After paying off the loan for the entire amortization period, the borrower can own the whole real property alone.

Second Scenario: Fund Raising Against Owned Property

In this scenario, the borrower needs money for other purposes like a wedding or medical emergency. To fulfill his need, he puts his constructed property such as a house or a commercial building on the lien, and then in return, bank or financial institute bears all his expenses. There is a fixed amount needed to be paid back to the bank every month or year as per agreement.

If you miss the debt to pay back on time, the bank has full authority to take the possession of that property. This is used as collateral in the legal agreement between the borrower and the lender.

Advantages of Mortgage

- The mortgage is the best alternative of paying your house rent to the property owner and nothing yours at the end. Every debt payment adds some equity to a borrower in the property. Less the debt, more the equity borrower own.

- A simple mortgage calculator can help you calculate the monthly cost that you have to bear for owning a house or any other property.

- Another significant advantage of a mortgage is that the borrower can also earn some profit by selling the home to someone else for a handsome amount. Like if Mr. X wants to buy a real estate property worth 500K dollars. He has deposited 100k dollars as a down-payment—the remaining 400k dollars paid by the bank. After a few days, that real property has shown an increase in its worth like 600K dollars. The borrower can sell that property in 600K dollars, the profit of 100K dollars. He doesn’t have to split this profit with the bank. It is because the banks are not considered as partners in the mortgage. Borrower then returns 400K dollars of the bank at once and left with 200K dollars. A mortgage just helped him in doubling his investment.

How to Get a Mortgage

People, who want to get a mortgage, follow these steps;

1. Get the credit score where it requires

Check your credit report to ensure all the information it includes is accurate. If not, call the credit bureau to correct it. If the information is correct, find out your credit scores from the credit bureau.

2.Check the Debt to Income Ratio (DTI)

Mortgage lenders need to know how much debt you have compared to your earnings, and it is known as your DTI or debt to income ration, and the best it is, the best mortgage term you will receive.

3. Consider Your Down Payment

According to the mortgage lender, complete down payment is 20 % of the home’s purchase cost or price. By inserting 20%, you don’t have to pay (PMI) private mortgage insurance, usually between 0.5-1 percent of the loan.

4. Pick the Best Type of Mortgage

You have an option of various types of mortgage, and out of these, you select between a fixed-rate loan and adjustable-rate loan. You, mortgage lender, can also help pick the right type of mortgage.

5. Get Prequalified for a Mortgage

It is an informal process where you answer the mortgage lender’s questions. Depend on the information you give the lender, they will let you know whether you qualify for a mortgage or not.

Importance of Mortgage Calculator For People

It is beneficial for a borrower to calculate the mortgage before he collects money from the bank because it gives you a brief idea about the affordability and monthly debt payment even before you seize into it. But there are some parameters you should know before calculations. The exact information about these parameters can help you see the precise picture of what you are going to pay every month.

- Home Price – this parameter is the first thing you must know about.

- Downpayment – is the minimum upfront amount that is deposited by the borrower.

- Loan Term – debt payback duration, also known as the amortization period

- Interest rate – the additional Amount charged by the lender. Maybe fixed or variable as per borrower choice.

These are fundamental parameters that can help a borrower to estimate the mortgage roughly. Several other factors can be added to the calculator. All these additional parameters are associated with the lease, which the borrower has to pay every month. Such as;

- Property Tax – annual payment to the governing authorities against your property

- Home Insurance – a cost paid to the insurance company yearly for securing the property.

- Private Mortgage Insurance – PMI has to pay if the upfront payment is quite low.

- Homeowner Association Fee – monthly payment to the housing society for improving and maintaining the surrounding environment

- Other Payments – there many house expenditures like house maintenance cost

All these parameters are not part of a simple mortgage calculator. However, they provide you a complete overview of the total cost that you have to pay in owning the real property. It would help if you stuck to the necessary parameters only by having the rough view of the only mortgage that you have to pay every month.

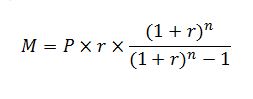

Mortgage Formulae

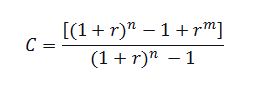

A simple mortgage calculator is working as per built-in formulae for calculating the fixed monthly payment and remaining loan payment. These calculators prevent you from great mathematical solutions. If you want to calculate your fixed monthly payment and remaining loan balance, their formulae are;

1. For Fixed Monthly Payment

2. For Remaining Loan Payment

where,

P = Borrowed Amount from Bank

r = Interest rate per month

n = total number of installments or loan term

m = total paid installments

Conclusion

A mortgage loan can help you to buy your own house even when you don’t have that much money. The borrower may have his inside perils about the mortgage. A simple mortgage calculator helps you to calculate the month fixed Amount with the change in different parameters.

This calculator than makes it easy for you to check the feasibility for a mortgage that either it is affordable for you or not. There are several websites, software, and handheld equipment that offer easy calculations and prevent you from going for mortgage formulae manually.

There are several factors that you can add to your calculations. Still, a simple mortgage calculator sticks you to the necessary parameters and draws an overview to check your affordability.

Subscribed to our website to get additional info about the morgage.

prescription allergy medication without antihistamines prescription only allergy medication 3rd generation antihistamines list

medicine to neutralize stomach acid cefadroxil pills

buy accutane 40mg without prescription order isotretinoin 10mg generic accutane 10mg price

top selling sleep aids buy provigil pills

amoxil 500mg pill amoxicillin 1000mg uk amoxicillin 500mg tablet

buy generic azithromycin azipro usa where to buy azipro without a prescription

buy lasix 100mg sale order lasix 40mg sale

prednisolone 5mg ca omnacortil tablets prednisolone 5mg oral

buy deltasone 20mg online where to buy prednisone without a prescription

buy amoxicillin pills for sale purchase amoxil cheap amoxicillin

acticlate tablet doxycycline 200mg for sale

albuterol inhalator ca albuterol inhaler order albuterol sale

order augmentin 1000mg for sale buy augmentin no prescription

purchase levothyroxine without prescription buy levothyroxine generic buy synthroid without a prescription

vardenafil 20mg sale purchase vardenafil for sale

oral clomiphene 50mg clomiphene 100mg cost clomiphene 100mg pills

tizanidine 2mg sale order tizanidine buy tizanidine sale

oral rybelsus 14mg rybelsus 14mg sale order rybelsus 14mg sale

deltasone cost buy deltasone 10mg online cheap deltasone 5mg for sale

rybelsus uk buy semaglutide for sale order rybelsus online cheap

accutane cheap buy isotretinoin 10mg accutane price

cheap amoxil generic amoxil 250mg price cheap amoxil pill

ventolin inhalator canada albuterol 4mg oral best antihistamine for runny nose

buy zithromax without prescription where to buy zithromax without a prescription azithromycin 500mg sale

buy generic augmentin online amoxiclav ca augmentin cost

prednisolone 10mg generic order prednisolone 10mg without prescription cheap omnacortil generic

buy generic neurontin online neurontin generic gabapentin 800mg pills

purchase lasix pill lasix 40mg without prescription lasix 40mg tablet

sildenafil 100mg tablet viagra for men sildenafil professional

buy doxycycline 200mg without prescription acticlate tablet monodox sale

buy rybelsus 14mg sale rybelsus without prescription cost rybelsus

online casino gambling online roulette wheel doubleu casino online casino

purchase levitra generic order vardenafil 10mg online cheap buy vardenafil generic

purchase lyrica generic order pregabalin 150mg generic purchase pregabalin without prescription

purchase plaquenil online cheap buy plaquenil 400mg sale plaquenil generic

triamcinolone price triamcinolone buy online triamcinolone where to buy

cialis 10mg sale purchase tadalafil generic tadalafil 40mg pill

brand clarinex 5mg buy clarinex without prescription desloratadine price

how to get cenforce without a prescription buy generic cenforce where can i buy cenforce

highest rated canadian pharmacies cialis mexico pharmacy

northwestern pharmacy canada company website

buy generic loratadine online cheap loratadine 10mg order loratadine 10mg generic

order aralen 250mg online buy aralen no prescription chloroquine pill

buy priligy tablets cytotec 200mcg sale order misoprostol pill

orlistat 60mg price order diltiazem online diltiazem online

order zovirax purchase zyloprim pill zyloprim oral

northwestern pharmacy canada http://canadianphrmacy23.com

cialis canada online pharmacy canadian pharmacies online canadianphrmacy23.com

buy domperidone pill order domperidone generic brand sumycin

omeprazole 20mg price order prilosec 20mg pills order omeprazole for sale

buy metoprolol 50mg lopressor canada order lopressor generic

buy cheap generic depo-medrol methylprednisolone oral buy generic medrol

hire essay writer buying essays online thesis writing

buy methotrexate online generic methotrexate 5mg medex for sale online

oral reglan 10mg losartan ca hyzaar drug

buy meloxicam 7.5mg without prescription cheap celebrex 200mg celebrex 100mg canada

nexium 40mg pill brand nexium 40mg topiramate 100mg usa

buy flomax generic buy celebrex 200mg for sale celebrex 100mg us

order ondansetron 8mg online buy zofran 8mg pills order spironolactone online cheap

where can i buy avodart ranitidine buy online ranitidine 300mg sale

zocor order online purchase valtrex generic buy valacyclovir medication

buy generic ampicillin cheap generic amoxil amoxicillin over the counter

order proscar 5mg generic forcan where to buy order fluconazole 200mg