Find out how to Make investments Cash?

All of us get pleasure from shopping for stuff and buying gadgets which are significant to us. However, the reality is that investing cash and doing that in a sensible means is what’s going to push us in the best route. Studying tips on how to make investments cash is essential, it will possibly make an enormous distinction, and it pushes the boundaries relating to having fun with life and simply having enjoyable for a change.

Investing is thrilling since you get to set cash apart for these dark occasions. It’s quite a lot of enjoyable, and you will discover your self making ready for the years to return. Plus, lots of people earned a ton of cash by investing, and you are able to do the identical.

- The GREATEST PHILOSOPHY IN INVESTING CASH

- Invest money in Bonds

- Mutual funds

- Buying and selling stocks

- Robo-advisors

- Certificates of deposit

- Savings accounts to invest money

- Treasury securities

- Invest Money on Physical commodities

- S&P 500 index funds

- Nasdaq 100 index funds

- Invest money in Real estate

- Cryptocurrencies in money investment

Greatest philosophy in investing cash

:max_bytes(150000):strip_icc()/GettyImages-503847901-5774829c5f9b585875cd689c.jpg)

One of the crucial essential concepts behind investing is to by no means add all of your eggs in the identical basket. Which means you shouldn’t depend on only a single sort of funding. Some investments are dangerous, you’ll be able to find yourself shedding your cash or there may be issues. To keep away from that, you’re quite a bit higher investing at an early age and simply go from there. It’s completely priced it, and it will possibly push you in the best route with none main worries.

Make investments cash in Bonds

Investing in bods is an excellent concept as a result of they’re a debt safety designed to lift capital. These bonds are getting cash for the US Authorities, native tasks and new corporations. This is likely one of the most secure methods to take a position, even when there are some small dangers. These are cheap, and you will discover your self acquiring some wonderful outcomes and advantages.

Mutual funds

Whenever you spend money on mutual funds, you’ll discover it is a managed funding system. That is including up your cash with different traders and the fund supervisor will use all funds to purchase securities for the complete group. What this implies is you get to spend money on an enormous vary of bonds and shares in a single transaction. You don’t need to commence your self, which helps quite a bit if you happen to be a newbie on this area.

Shopping for and promoting shares

You’ll be able to work with a knowledgeable that does this for you, or you’ll be able to go the DIY route. The difficulty right here is that you’ll want to pay quite a lot of consideration to the market, the way it grows and adapts, amongst different issues.

Promoting and shopping for shares isn’t straightforward, you’ll want to research the market and purchase or promote on the proper time. That’s as a result of shares are fluctuating, and you’ll want to be extraordinarily cautious relating to managing your shares. In fact, you would decide an enterprise with plenty of potential and simply spend money on it with the concept that their shares may have an enormous value sooner or later.

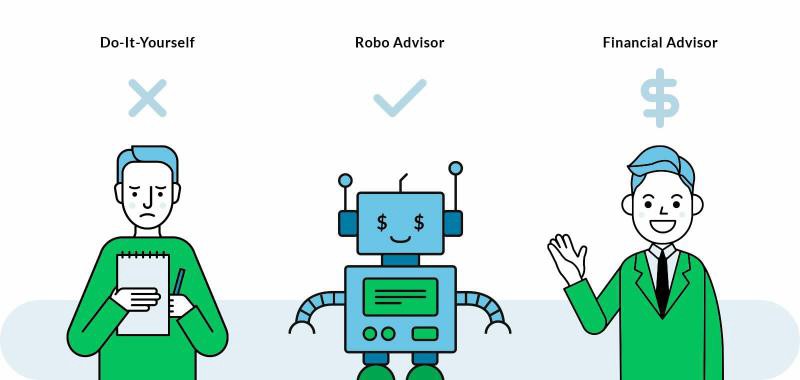

Robo-advisors

These apps began to seem some time in the past, and they’re fairly unbelievable. The thought is that you simply begin with a low amount of cash and robots will use machine studying to supply funding recommendation. That is truly one of many coolest methods to take a position cash, and it continues to shine relating to the worth you get. Most individuals begin off with low quantities, however this will turn into a major funding answer in the long term. Some nice examples on this area are M1 Finance, Wealthfront, Betterment and plenty of others like that.

Certificates of deposit

The certificates or deposit are issued by the banks they usually herald a rate of interest larger than financial savings accounts. These are federally insured timed deposits they usually can vary from just a few weeks to a number of years. Nonetheless, the catch right here is that they’re timed deposits. You’ll be able to’t withdraw your cash except you need to cope with a penalty. The very best factor you are able to do is await the certificates of deposit to run their course, and also you reap the earnings in the long run. These are secure investments with a really excessive payout fee. Due to this fact, they could be an excellent possibility if you need a seamless and secure method to spend money on the long term.

Financial savings accounts to take a position cash

There’s additionally the choice to go to a financial institution and begin your personal financial savings account. It helps quite a bit and the perfect half is that you could set cash apart with none of the main challenges. Whereas the rates of interest differ from one financial institution to the others, it is a nice method to make investments and get some a reimbursement. Certain, the general charges are usually not the perfect except you will have some huge cash, however it’s a place to begin for any sort of funding.

Treasury securities

We’ve seen lots of people spend money on Treasury securities for the previous decade or extra. The way in which these works are the US Authorities is issuing securities with the thought of elevating cash for tasks and pay numerous debts. These are secure investments for you, since you’re coping with the Federal authorities and there are little dangers concerned.

They’ve maturity of round a yr or much less, they usually don’t have curiosity. Then how do you earn money? Their worth will increase in the long term and the Authorities can pay face worth for them. So if you happen to acquire the securities a yr in the past and the worth was $50 decrease, then you definitely make $50 for each safety you acquire.

Make investments Cash on Bodily commodities

A variety of traders go for physical commodities as a result if they provide amongst the best methods to take a position without having to fret that a lot about issues. It’s an artistic, rewarding method to make investments, and it will possibly herald entrance some attention-grabbing concepts so that you can give attention to.

Gold and silver are traditional investments, and traditionally they at all times raised their worth. That makes gold in addition to silver an excellent funding. Nonetheless, you’ll want to understand that demand for commodities can typically go down. You simply must know when to purchase and when to promote. Regulate these costs and make good selections if you need the perfect outcomes.

S&P 500 index funds

The S&P 500 index funds are nice if you need larger returns when in comparison with any banking merchandise. These funds are based mostly on Fortune 500 corporations. Walmart is a superb instance of firm that’s part of this index. You might have loads of diversification, and you may select an enormous vary of various funding alternatives to consider.

The wonderful thing about S&P 500 index funds is that you could get them with a relatively low funding ratio and the perfect half is you’ll be able to diversify your investments naturally. It helps quite a bit, particularly if you happen to’re new to this, and you may be fairly proud of the expertise.

Nasdaq 100 index funds

You’ll be able to go along with the Nasdaq 100 index funds if you need publicity to excessive tech corporations. It is a good funding concept since you don’t have to research corporations. The fund itself covers corporations like Microsoft, Amazon and Apple, corporations with a longtime observe document.

It actually is a superb funding strategy for newcomers and whereas the return is a decrease when in comparison with different investments introduced right here, you’re nonetheless getting quite a bit in your cash and that’s what actually issues on the finish of the day. Simply verify that out and maintain it in thoughts, you’ll actually respect the outcomes and expertise itself.

Make investments cash in Actual property

You probably have a good amount of cash put aside, you’ll be able to spend money on actual property. The way in which these works are you purchase a property, restore it and then you definitely both hire it or promote it to somebody. It won’t seem to be quite a bit, however that is by far amongst the best methods to take a position, and it will possibly herald entrance some unbelievable advantages.

Lots of people consider in actual property investing as a result of its environment friendly, it delivers nice worth and there are little dangers right here. Traditionally properties will enhance their worth, so that you begin off sluggish, and then you definitely go from there. It could result in some unbelievable ends in the long run, simply attempt to take that into consideration.

Cryptocurrencies in cash funding

This isn’t the perfect funding possibility as a result of it may be dangerous. Whereas crypto costs change typically, there are some which traditionally went up, like Bitcoin, Ethereum and Litecoin. Identical to inventory investing, this requires quite a lot of market analysis.

An excellent rule of thumb is to spend money on these cash with a restricted provide, as they are going to finally turn into very costly, and that’s precisely what you’ll want to give attention to. On the finish of the day, cryptocurrencies have the potential to turn into an awesome funding possibility, however they’re very dangerous presently. You’ll be able to find yourself shedding cash very simply. After all, the crypto costs change each hour, so the long-term potential of those remains to be being decided.

Conclusion

It’s secure to say that investing your money is likely one of the greatest methods to realize monetary success in the long term. It’s not straightforward to start out investing, as there are such a lot of choices. Nonetheless, the choices introduced listed here are identified to be very secure they usually assist you defend your earnings in the long term. Take all of that into consideration and bear in mind, every one amongst these can carry your earnings. You simply want to check the market and make good selections along with your funding!